How to Adopt a Customer-first Mindset for Financial Services Organizations

Time to read: 9 minutes

The responsibility for excellent customer service spans the whole of a financial institution. Yet, if not addressed, the consequences of a disappointing customer experience can seep into every nook and cranny of a business. It can ruin deals, decrease the lifetime value of your customer relationships, and crush decades of top revenue performance.

AND (this is the most infuriating part 😡) it can be difficult to measure. Thanks to NPS scores, we see a superficial view of the performance of your organization from the customer’s perspective. But does it really get to the heart of what is keeping you from building loyalty and creating genuine and profitable connections? Does it give you the insights you need to defend your customer experience technology capital expense to your executive board? I’ve never been in a financial services board room, but my guess is it’s unlikely that most traditional executives are going to look at a negative trending graph and declare, “by Jove! It’s the customer experience!” 🎩

Happily, the term, importance, and future of customer experience is rising in priority thanks to heightened customer expectations. Jeroen de Bel, Founder of Fincog and guest author on The Paypers talks about how customer experience is impacting the future of financial institutions:

“For the banking sector, customer experience is becoming the focal point of differentiation. Services are being provided in ever more personalised ways, at the right place, and in the right form for clients. This is particularly enabled by Open Banking, allowing banks to build upon customer data and advanced analytics to deliver enhanced capabilities and customer experience. Open Banking can be leveraged to optimise the entire customer journey, from the point of orientation and acquisition to post-sale customer care.”

If your organization is at one of those pinch points where they know that they need a better customer experience but aren’t quite sure how to get it, you’ve come to the right place. By adopting a customer-first approach to your financial services experience, the potential for true transformation is possible. Here’s a quick guide on how to get started.

What is a customer-first mindset when it comes to financial services?

To build a customer-first mindset for financial services, there are a few things you’ll need to consider. First of all, “90% of leaders report that customer expectations have increased to an all-time high,” according to Hubspot’s State of Service report. And according to Forbes, small businesses want technology that enables them to easily manage their business 24/7 while having access to people they know and trust.

What a customer-first financial organization looks like 🔍

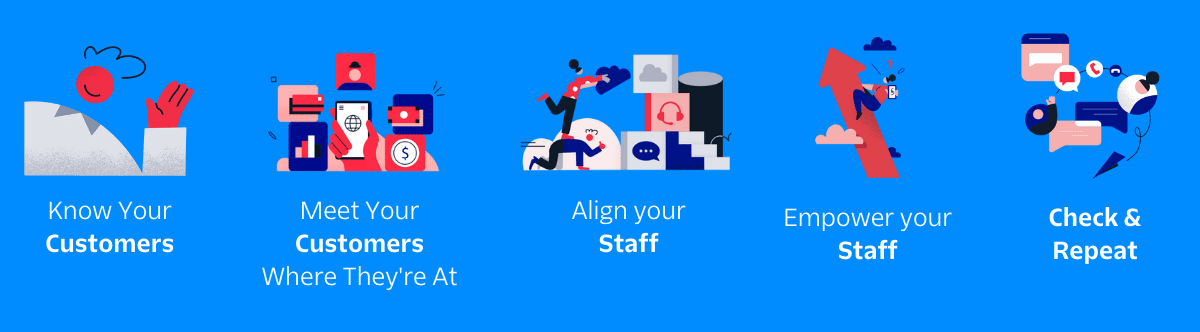

- You know your customers and their expectations - You know that people want a better customer experience, and you understand what that means to them. You have a deep understanding of your unique customers, clients, and members. You know what they need and want based on anything from accessibility to convenience to security requirements and are actively mapping out how you can make their lives easier.

- You meet your customers where they’re at - You know your customers, members, and clients as well as their skills and comfort zones. You understand different generations and have different technologies available to them. You have the elements in place to meet their needs no matter what camp they fall in.

- Your staff is aligned - Whether they are customer- or client-facing or behind the scenes making the magic happen, your customer-first approach is well communicated to your staff. They understand the changes that are being made, who they will impact, the timeline it will roll out, and what the future could look like. The results: the customer experience is far greater than the sum of their parts.

- You empower the staff to take care of the customers - Thanks to a strong customer-first approach, your organization has invested in the right types of technology to help ensure that information is shared across the organization. Your teams are empowered to connect with customers on their preferred channel and customers don’t have to repeat themselves as you troubleshoot their problems.

- You check and repeat regularly - Your financial services organization knows that without a solid check and balance system, your customer-first approach can be tentative. You audit best practices across the organization regularly. You build onboarding programs that help indoctrinate your new employees into your passionate culture. You create strong dashboards to show you what elements of your customer experience efforts are working and which are not.

Talking about what works is easy. Putting it into action is where many financial institutions (FIs) get tripped up. When it comes to executing a customer-first experience, frictionless transactions and convenience are key.

🧶Crafting a customer-first experience for financial service customers

When it comes to crafting a customer-first experience, it’s all about setting expectations. Not just with your customers, but with your employees and vendors as well. This type of level setting up front can help set the tone for everything from hiring decisions to technology choices, to establishing what types of customers are a great fit for you. When you start the conversation with a phrase like “We’re a customer-first organization,” you’ve helped establish the priorities you seek to execute from the first moment.

Speaking the words is the first step. The next step is all about ensuring that you can put your money (🤑) where your mouth is.

Go Get to Know Your Customers

Your customers come to you for a reason. Whether it’s the location, convenience, products and services, or the best darn agent that helps them solve their problems, you’ve got something your customers want. Use internal customer data, customer interviews, conversations with customer service agents, and advertising data to build an understanding of your best customers for each product or service line. Or simplify the whole process by engaging with a customer data platform (CDP) to get the insights you need at a glance. Doing that will help you understand what is important to them and help you prioritize your ongoing investments.

Understand Their Communication Styles

People don’t communicate like they used to. The majority of the US population was born after 1965 and is generally well acquainted with digital communication. Although there’s still room for in-person communication channels (especially in the face of a large decision), the need for face-to-face support we once needed is dwindling. The majority of generations communicate by electronic means and generally rely on their handheld electronic devices. In a truly customer-first approach, the customers set the tone, and banks, insurance agencies, credit unions, and brokerages need to follow their lead.

Ensure that Staffers Can Deliver

Most of us have heard about Wall Street brokerages getting heavily fined for using unregulated channels of communication. Because the expectation is that world-class brokerages are keeping up with the preferred communication channels, agents were backed into a corner: deliver on customer expectations or lose the deal. In the end, transactions need to be seamless, safe, and easy. When done with the customer (and their security) in mind, it’s possible to avoid painful fines.

In a discussion with The Financial Brand, Brad Brodigan, Managing Director and Global Head of SMB Payments at J.P. Morgan, shares, “Measures such as two-factor authentication, text message confirmations, and geotargeting are making digital payments increasingly secure. Combined with the backing and trust of a major bank, these innovations are making digital payments even more safe than traditional payments.”

Your employees need to be empowered to make that happen with technology options that remove friction while keeping customer data safe.

Measure Success

Prioritizing a customer-first approach is all well and good, but how do you know it’s working? The Net Promoter Score is a great start. It may make sense to weave in the Customer Satisfaction score as well. The Customer Effort Score is a survey that determines how user-friendly your products and services are. Whereas the Customer Health Score is an overall summary of a customer’s satisfaction with your business including historical data to create a “sentiment” about your company. More simply, monitoring the abandonment rate for your interactions through the contact center or your conversion rates can give you a sense of how well your agents are helping people move through the buyer’s journey.

When you manage the expectations of customers, team members, and the impact technology can have on the customer experience, you’re far more likely to see the needle move🪡.

Getting it right👍: customer-first approach brand examples

In writing courses, instructors emphasize showing your work over telling people about your work. Well, I think that’s also true when it comes to showing great examples of customer-first approaches. That’s why in the next few paragraphs, you’ll see real-life Twilio use cases putting the above ideas to work. Check them out:

Flex from Text-based Chat to Phone and Back Again

Northmill is a Swedish Fintech innovation company, founded with the vision of simplifying everyone’s financial life. They sought to empower agents to handle customer interactions faster while still delivering an excellent experience.

“We aim to provide services where customers can reach us by any means, especially mobile phones and phone calls,” says Ville Kymalainen, Northmill’s Finland Country Manager.

“It’s really important for us to be able to be there for the customer, not just by having a chat function…If you want to reach an actual person, we’re there for you.”

Marcin Ziółkowski, CTO of Swedish fintech innovation company

In the end, they employed Twilio to build an integrated call system to be able to track spikes and serve them better. Ultimately, they were able to serve a hundred more customers a day and increase the efficiency of their agents by 50% because all of the customer information is available with just one click. Customer-first methodology in action, for the win!

Secure Text-based Messaging for Financial Services? Yes, Please!

Singlife is a mobile savings and protection company in Singapore that began with a simple idea: reimagine the way people experience insurance and make it better for them. Customer service was at the forefront of their priority and they needed a way to provide personal, secure, and convenient messaging options. Singlife employed Twilio to help craft an SMS solution to offer alerts and one-way notifications. For two-way conversations to handle more complex customer queries, they deployed secure WhatsApp messages. It didn’t stop there, however, personalized service was at the heart of the offering. Here’s an excerpt from their Twilio story:

“To make Singlife’s WhatsApp experience more intuitive, the customer service team needed to be able to identify who each customer was from the moment a message is received. This required WhatsApp messages to be routed through Singlife’s Salesforce omni-channels. To enable this, Singlife used Twilio’s Programmable Messaging API and designed a customized platform, integrating customer profiles with WhatsApp messaging for a more seamless experience.”

WhatsApp conversations with customers prove to double their chances of becoming a verified Singlife Account user. By matching the sender’s WhatsApp number to the mobile number registered with the Singlife account in its Salesforce database, customer service representatives get a full view of customer profiles and history the second a message is received.

Personalized Interactive Voice Response (IVR) for Chime

San Francisco-based leader in US challenger banking, Chime, is focused on delivering an unrivaled customer service experience to build customer loyalty. As they were iterating their customer experience, they wanted to provide a personalized member support experience that would flex and respond to analytical insight using Twilio Segment.

“We wanted to provide a personalized support experience that solved our members’ problems, and made it clear that they were banking through a partner that had their back,” Bustelo-Killam said. “We needed a technology partner [like Twilio] that could integrate seamlessly across our stack and help us iterate quickly using analytical insights.”

Using programmable messaging, and an evolved, highly personalized interactive voice solution for all levels of inbound support, they were able to put this into play in just four weeks and they saw a 12% improvement in customer satisfaction.

The next evolution of customer-first mindset

As the customer-first mindset evolves, customer expectations will continue to rise. According to Gartner’s Future of Customer Service report, the trends to watch out for are:

- increased value coming from people in customer service roles (psst 👂, that’s everyone)

- privacy-led experiences (that’s already a top priority for financial services)

- machine virtual assistant requested service (people are using more automated VAs than ever thanks to their busy lives)

- service in third party channels (like Reddit, YouTube, etc)

- voice of the customer data (augmenting survey, providing actionable insights to improve service interactions)

The customer-first mindset will continue to be core to long-term success. It’ll be interesting to see how financial services leverage some of these lesser leveraged future-proofing tactics as it continues to evolve. We live in exciting times!

Maureen Jann is a Senior Content Marketing Manager at Twilio. She has over two decades of experience as a marketer and has helped fintechs, financial service organizations, and healthcare organizations level up their marketing strategies. Maureen has a Bachelor's of Art from San Jose State, and an MBA from the School of Failed Startups. She is a frequent speaker and guest writer for popular marketing industry organizations and lives in the Pacific Northwest with her husband, daughter and dogs.

Related Posts

Related Resources

Twilio Docs

From APIs to SDKs to sample apps

API reference documentation, SDKs, helper libraries, quickstarts, and tutorials for your language and platform.

Resource Center

The latest ebooks, industry reports, and webinars

Learn from customer engagement experts to improve your own communication.

Ahoy

Twilio's developer community hub

Best practices, code samples, and inspiration to build communications and digital engagement experiences.