Customer Experience Management for Financial Services

Time to read: 7 minutes

Whether driving marketing results, leading customer service teams, or making strategic technology decisions, financial services leaders have a tough job. You’re managing siloed data, shifting customer requirements, handling data transparency demands, and are under pressure to do it as the market changes like sand under your feet.

The most difficult part, it seems, is that so many of you are doing it alone. I don’t mean that you walk into an empty office (although if you’re working from home, you might be working with your pet poodle🐩). Instead, I mean that the work you’re doing is too often disconnected from critical information and collaborators. This happens because of legacy business practices, technology, and even people who act as cultural blockers to change.

If you work at a larger, more established financial institution, you’ve most likely heard the phrase “but we’ve always done it this way” in response to a suggested change or improvement. Cultural stagnation is baffling because financial institutions are there to make money, not do things the way they’ve always been done. And as neobanks and fintech companies are changing the landscape of the industry, evolution is the only way to survive. Departmental stakeholders might as well stick together, otherwise, you’ll be placed into a metaphorical Thunderdome (two people enter, one person leaves!🥊) every time legacy thinking is challenged.

Ultimately, what all parts of the organization are trying to do is increase customer lifetime value (Investors Bank has a nice definition if you need a refresher). The best and most sustainable way to increase the customer lifetime value is to double down on creating a single customer journey from marketing to sales to post-sale customer experience. In order to master customer experience management in financial services, you need to engage prospects and customers alike, with personalized messages at the right time and frequency for each customer. They need to be delivered in channels that the customer prefers without sacrificing security. We call it intelligent engagement, and it’s going to change everything.

What is customer engagement management?

But first, let’s set some foundations. What is customer engagement management? It’s highly likely that you’ve implemented elements of it, but you might not call it that.

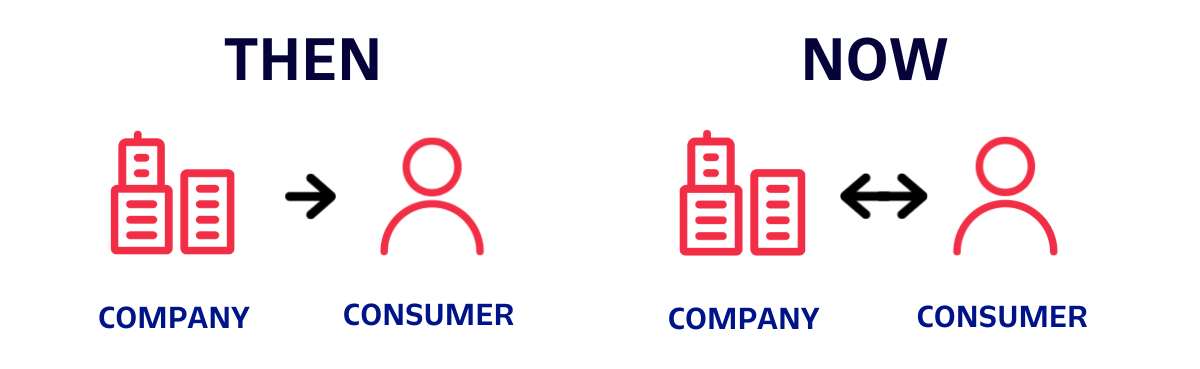

For a long time, brand-to-consumer interactions were just a one-way street. If you were born before the internet (guilty 🤪), the primary mode of marketing consumption from any kind of brand ranged from static ads served via magazines, billboards, television, and newspapers. Communications received from your financial institutions came first via mail and then via email. Case in point, I’m sure you’ve seen notes at the bottom of automatically generated emails that say, “Please don't reply to this automated message; responses are not monitored.”

As technology has evolved, financial organizations started to feel pressure to take this from a monologue (organization-to-consumer) to a dialogue (organization-to-consumer-to-organization). Then the pandemic happened and consumers had zero intention of going into a bank. That meant the expectation to have a dialogue from a safe distance was a requirement to do business with customers, members, and clients.

Today, the demand to make this two-way street as impactful as possible is critical because digital fatigue is very dangerous to the financial industry’s individual brands and overall reputation (watch out for the sharks🦈 in that article). In fact, 60% of consumers report that they “sometimes, often, or always” disable push notifications, according to our new report: Conversational Messaging: The Next Storefront Experience.

That’s where customer engagement management comes into play. Qualtrics did an audit of the term across credible sources. They were able to craft an aggregate definition, worded as such:

“Customer engagement is the emotional connection between a customer and a brand. Broadly speaking, customer engagement (CE), or customer-brand engagement (CBE) encompasses the customer’s relationship with a business.”

The management of that CE or CBE is how you nurture that relationship. So, how can financial service organizations manage and nurture their relationship with customers and prospects without burning them out? That’s where intelligent engagement comes in.

Growing financial service customer lifetime value

I think it’s safe to say that if financial organizations are better able to nurture their prospects and their customers, they will see higher conversion rates and customer lifetime values. But what does “better” even mean?

Better nurturing prospects and customers means providing a fully personalized journey from tip-to-tail. Here’s how.

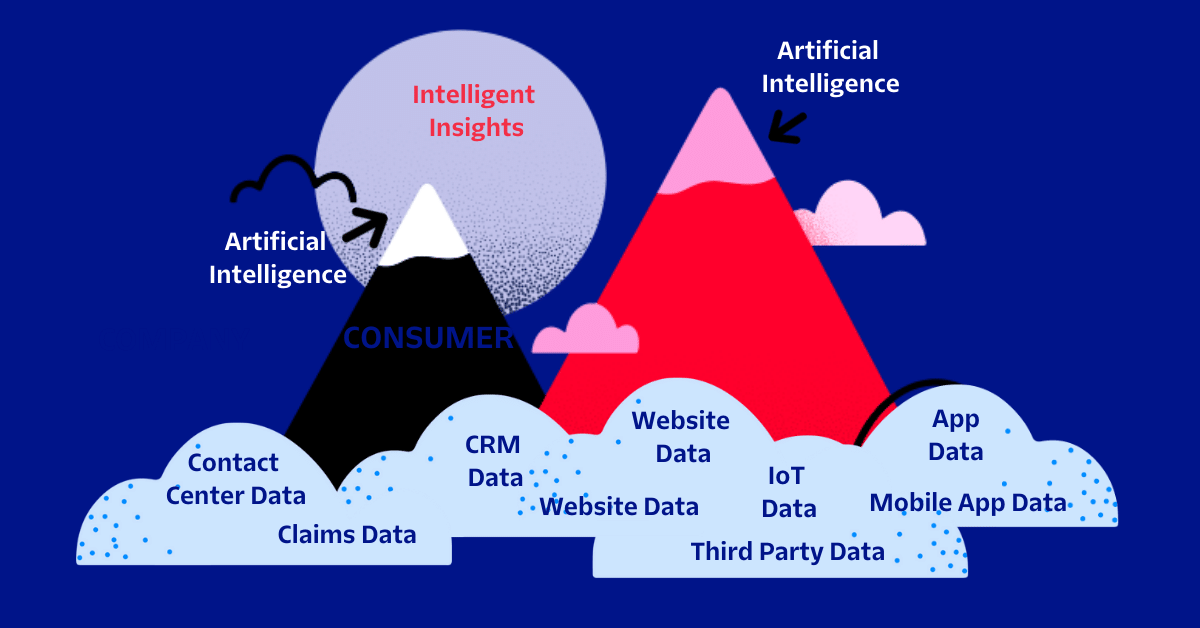

Most financial institutions are collecting data across their customer’s journey. The real victory is when they can enable all of those data points to encourage prospects and customers to advance their buying decisions. McKinsey shares best practices to ensure that organizations can use the data they’re collecting to their advantage:

“To estimate the current and future value of customers and keeping privacy regulations in mind, companies need to collect relevant data points on as many customers and their behavior as possible over multiple years. This is because the corresponding analytical models are dependent on the availability of sufficient amounts of information to identify relevant patterns.”

The planning and strategy around growing your customer lifetime values are important, and engaging that strategy brings your organization much closer to the customer. Here’s what it could be like when activated:

Pre-purchase

Using data collected from every interaction on your website can act as a strong base for getting to know your customers. That can include your mobile apps, social media interactions, digital ads, marketing automation systems, and anywhere else you might be collecting pre-purchase data. In action, here’s what it could look like for you:

Company: Farmer’s Insurance

Challenge: An organization heavily reliant on engineering and analytics departments to make decisions across the organization, sales, marketing, and product needed more autonomy to better serve their prospects. They needed the ability to quickly create customer-facing offers and messages. In the past, getting the necessary data could take weeks.

Solution: Using a flexible solution (Segment) to draw together points of data (claims, CRMs, contact center information), they were able to speed up strategic launches, automate messages, and glean insights from a new marketing and analytics stack in just 30 days.

Outcome:

- Decreased cost per acquisition by 64%

- Increased sales by 67% in record time

- Able to ship campaigns and product updates 4x faster

- Increased ROAS (return on ad spend) with more targeted audience segmentation

Post-purchase

Creating a single customer profile that can be accessed by every team in your business is the key to ensuring that you’re both managing your customer experience and accruing accumulative value with your customer for long term payoff. Here’s what that could look like for you:

Integrate customer data to create a seamless journey

Company: Debt Free London

Challenge: In order to scale the financial advice they were giving to help people get out of debt, they needed to activate digital transformation strategies to help them respond to an increasingly digital world. Their IT infrastructure was siloed, so users needed to log in to several different platforms to get answers to their time-sensitive questions.

Solution: Debt Free London turned to Ciptex to build a contact center solution on a flexible content stack (Twilio technology stack). Thanks to this partnership, there was a centralized customer engagement management center that allowed them to engage across multiple channels, including video calls.

Outcome:

- Increase in contact handling capacity after deployment

- In just 90 days, DFL had 15k conversions

- They were able to scale their costs based on usage

Barriers to a 360 Degree View of the Customer

Logically, when an action is taken or a behavior is demonstrated, it makes sense to trigger a complimentary offer to a prospect. But there are always barriers to progress. Here are a few examples we’ve run into as we’ve worked with the financial industry:

- Constantly Shifting Customer Demands - Customers are wily. But we love them, don’t we? Although it would be handy to be a mind reader or a medium when we are trying to predict what our customers want next 🔮, financial institutions are often in the position of responding to rather than proactively managing new customer behaviors. Of course, technology-first financial companies are popping up to respond to these shifting needs in real-time. Organizations are often led by someone who was once the customer they are catering and they have a unique insight into what is expected. All the while, with every shift, the bar raises.

- State of Systems - You’ve got old systems? You’re not alone. Twilio talks to customers every day that are working with, not just one, but a multitude of legacy systems. With multiple products and processes requiring different functionality, creating a useful one-stop shop for customer information is, to put it mildly, challenging. Then you add another challenge: on-prem applications vs. SaaS vs. proprietary applications. Barriers to connecting old and new and incompatible technologies re-platforming can seem like the only option for those invested in the long-term health of their financial organizations.

- Cleanliness and Portability of Data - When you have old, siloed systems, data portability makes layering in more innovative technology that will respond to those shifting customer needs more difficult. And that's not even taking into account data cleanliness. Old systems have old formats. Even if you can get one system to connect with another one, the data format will likely be unusable from one system to the next. Without someone or something reformatting that data to accommodate the proprietary configuration, even the most insightful data is worthless.

Paving the Path to Success

All is not lost. Despite the barriers financial organizations face when building their customer lifetime value, there has been clear progress toward an ideal future. Technology is advancing and stakeholders are actively shifting their perspectives on the importance of the digital experience. But the key is (surprise, surprise 🎁🎉) a combination of people, processes, and technology.

Although the promise of using technology to increase the customer lifetime value may seem like the silver bullet you’ve always wanted, the reality is that the maturity of your organization lies in:

| PEOPLE | PROCESS | TECHNOLOGY |

|---|---|---|

| Corporate sponsorship | Input and usage approaches | Flexible options |

| Value to the organization | Internal handoffs | Integrations |

| Impact on employees in their day-to-day | Internal uses of data | Scalable |

| Measurement of success | Offer insights on collected data |

Maureen Jann is a Senior Content Marketing Manager at Twilio. She has over two decades of experience as a marketer and has helped fintechs, financial service organizations, and healthcare organizations level up their marketing strategies. Maureen has a Bachelor's of Art from San Jose State, and an MBA from the School of Failed Startups. She is a frequent speaker and guest writer for popular marketing industry organizations and lives in the Pacific Northwest with her husband, daughter and dogs.

Related Posts

Related Resources

Twilio Docs

From APIs to SDKs to sample apps

API reference documentation, SDKs, helper libraries, quickstarts, and tutorials for your language and platform.

Resource Center

The latest ebooks, industry reports, and webinars

Learn from customer engagement experts to improve your own communication.

Ahoy

Twilio's developer community hub

Best practices, code samples, and inspiration to build communications and digital engagement experiences.